dependent care fsa rules 2021

Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. If you are married and filing separately you may contribute up to 2500 per year per parent.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits.

. The Taxpayer Certainty and Disaster Tax Relief Act. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. Your employer may elect a lower contribution limit.

While it is optional we have decided to adopt this change. ARPA Dependent Care FSA Increase Overview. As a result rather than the previous maximum credits of 1050 and 2100 taxpayers can receive up to 4000 and 8000 for the 2021 tax year.

1 Optional provision. If you are interested in making a change to your DCFSA election. Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but changed for 2021 only.

The child and dependent care tax credit increased under the American Rescue Plan for the 2021 tax year of up to 4000 in. The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents who have not yet turned 14 for the 2020 plan year. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. For married couples filing joint tax. Limited Purpose Flexible Spending Account Complement your HSA and save more on dental and vision.

If a child turned 13 in the 2020 plan year AND the participant rolled over funds into. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. As more companies adopt the FSA.

Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money. This was part of the American Rescue Plan. Dependent Care FSA Increase Guidance.

Prior guidance provided flexibility to employers with cafeteria plans through the end of calendar year 2020 during which employers could permit employees to apply unused health FSA amounts and dependent care assistance program amounts to pay for or reimburse medical care or dependent care expenses. For 2021 the maximum credit has increased to 50 of eligible expenses and the maximum claim amount has increased to 8000 for one dependent and 16000 for two or more. Dependent Care Reimbursement Account Rules will sometimes glitch and take you a long time to try different solutions.

Furthermore you can find the Troubleshooting Login Issues section which can answer your. Employers can choose whether to adopt the increase or not. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. As with the standard rules the limit is reduced to half of that amount 5250 for married individuals. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend school full-time.

However if you did not find a job and have no earned income for the year your dependent care costs are not eligible. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022.

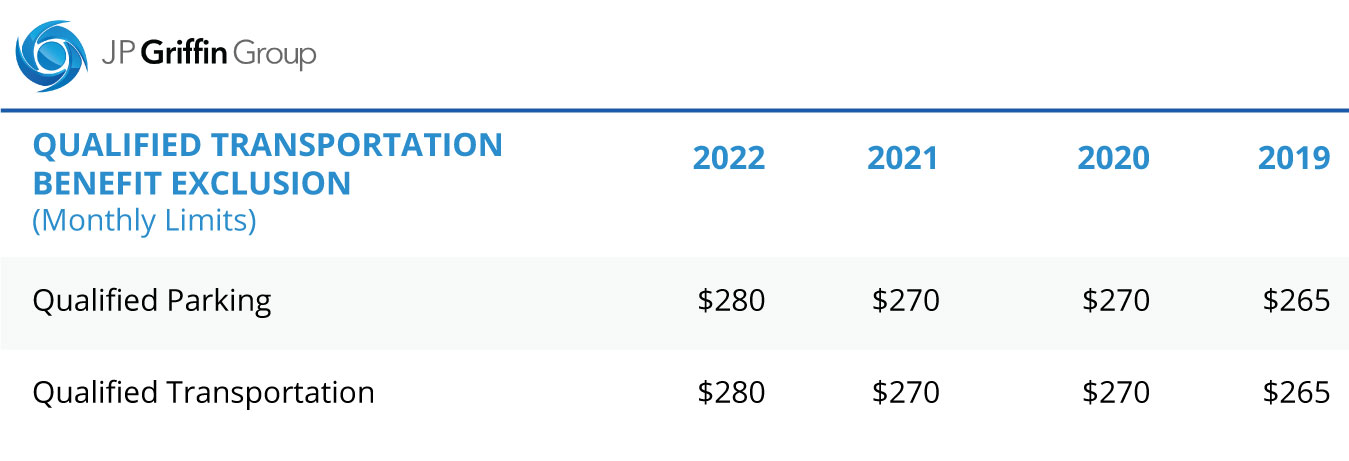

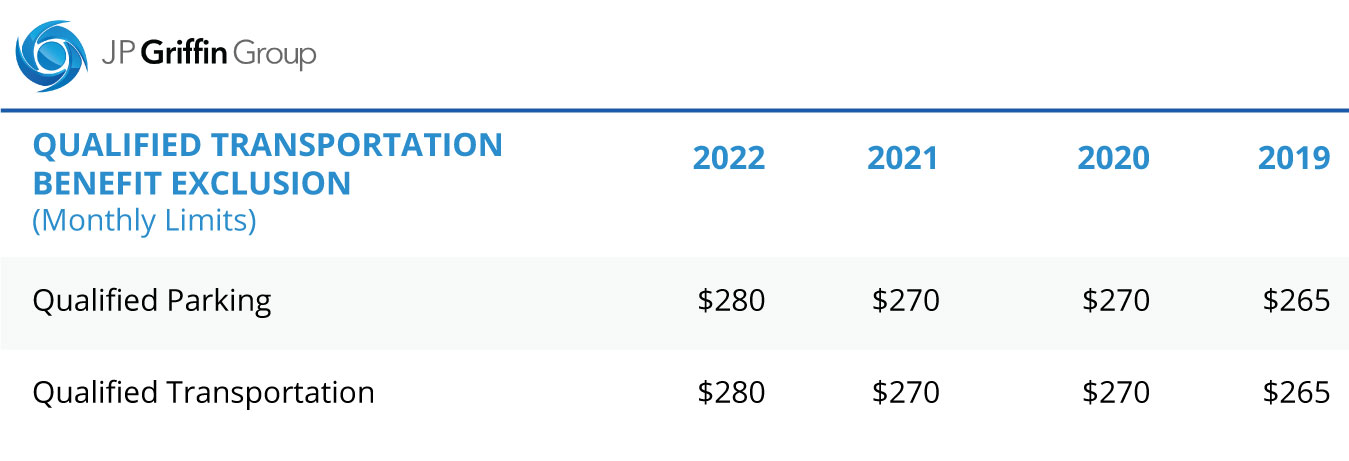

IRS Notice 2021-15 issued Feb. The most money in 2021 you can stash inside of a dependent-care FSA is 10500. The 2022 family coverage HSA contribution limit increases by 100 to 7300.

Dependent Care Tax Credit. The new contribution limit is 10500 for 2021 for single taxpayers and married filing jointly a limit that was previously set at 5000 per year. A flexible spending account FSA earmarked for dependent care also known as dependent care FSA or DCFSA is a tool that can shoulder some of these costs and help your employees make their dollars work a little harder.

The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday. The limit will return to 5000 for 2022. With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses.

Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit. For Dependent Care FSAs you may contribute up to 5000 per year if you are married and filing a joint return or if you are a single parent. Dependent Care FSA Eligible Expenses.

LoginAsk is here to help you access Dependent Care Reimbursement Account Rules quickly and handle each specific case you encounter. The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck. If you are divorced only the custodial parent may use a dependent-care FSA.

15 clarifies that employers may extend the dependent care FSA claims period for a dependent who ages out by turning 13 years old during the COVID-19 public. Up to a 12-month grace period For FSAs with a plan year ending in 2021 or 2022 employees can receive up to a 12-month grace period to use contributed funds.

Dependent Care Flexible Spending Accounts Flex Made Easy

Health Care Flexible Spending Accounts Human Resources University Of Michigan

Dependent Care Flexible Spending Account

Dependent Care Fsa Faqs Expenses Limits More Optum Financial

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is A Dependent Care Fsa Wex Inc

Understanding The Differences Between Runout Grace Period And Rollover Employee Benefits Corporation Third Party Benefits Administrator

Flexible Spending Accounts Ensign Benefits

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Dependent Care Fsa Dcfsa Optum Financial

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning